Image

With the right guidance and measures, starting a pooled fund is not as challenging as it seems. This page includes basic steps for being involved in pooled financing whether you are interested in establishing and launching an MPTF Office administered fund or scaling up and revising an existing one.

Steps for establishing a pooled fund |

Important documents | |

|---|---|---|

| 1. Convene stakeholder consultations and develop a concept note. Stakeholders (UNCT members, national governments, potential donors, civil society, private sector,) agree on added value, potential of the new fund, and map opportunities given existing financing mechanisms. The result is a concept note that outlines programmatic scope and purpose (LINK to standard UNDG template), along with financial and governance arrangements, and a preliminary analysis of financial viability (such as expected donor interest). |

|

|

| 2. Develop and agree on the terms of reference. Using the UNSDG ToR template, the UN Country Team and Resident Coordinator, in consultations with partners (which should include potential contributors), develop and agree on terms of reference narrative based on the concept note and spells out the function, objectives, and governance structure of the fund. Note: It is necessary to select an Administrative Agent (the MPTF Office for country-level pooled funds). | ||

| 3. Sign legal documents. Following UNSDG standards, Participating UN Organizations sign a Memorandum of Understanding (MoU) based on the approved terms of reference. Once signed the fund becomes active and legally established, although other Participating Organizations can join at a later stage. | ||

| 4. Conclude contribution agreements to capitalize the fund (following Standard Administrative Agreement (SAA) rules) and implement. The Administrative Agent concludes an SAA with donors who wish to contribute to the Fund and private sector contributors that are subject to an additional due diligence process. After the SAA is signed, the fund is operational and the Steering Committee is at liberty to convene and allocate resources. Resource mobilization is a joint endeavor of UN Participating Organizations, partners, and Administrative Agent, with UN Humanitarian Coordinators and Resident Coordinators taking on a leadership role for country-level pooled funds. |

| Build a business case. It is crucial from the beginning to make a strong case for the fund and communicate added value, taking into account the existing SDG financing landscape within a particular country, region, or a particular thematic priority. |

| Develop a robust theory of change. Each fund needs to respond to agreed priorities (for example, a global mandate or, for country-level pooled funds, the UN Cooperation Framework). The theory of change must identify how the fund will advance joint work towards priorities, perhaps through particular thematic, regional or intersecting areas that galvanize joint action. Funds are not a gap filler. They are a spark for fuelling outcomes and securing additional financing. |

| Keep it simple. Avoid the trap of unnecessary management or hierarchies, particularly cascading (double charging) overhead costs in some organizations or complicated accountability issues that occur in the absence of a UNSDG passthrough modality. |

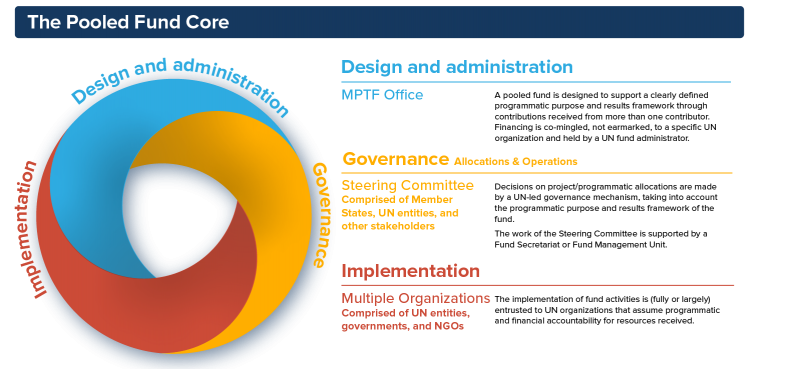

| Design a tailored governance structure. Fund success depends on having clear boundaries when it comes to roles and responsibilities. In country-level pooled funds UN Resident Coordinators provide leadership and coordination, and implementation is carried out by UN Participating Organizations, funds, programmes, and partners. The MPTF Office provides administration services and act as Administrative Agent. Each fund operates through a dedicated management unit or Secretariat. |

| Consider the fund as a center of gravity and alignment. Explore the fund potential to align projects and programmes, and reduce fragmentation caused by multiple/separate funding sources and projects. In some cases global funds, like the Peacebuilding Fund or Joint SDG Fund, allow for activities to be financed at the country-level. |

| Think “nexus.” Flexible pooled financing is suitable for cross-pillar and humanitarian-development-peace nexus work. |

| Limit earmarking. Pooled funds enhance flexible and strategic channels for investments so any earmarking should be at the outcome level (thematic area or cross-cutting issue) and not related to project type. |